First things first: for almost all dental complaints, there are treatment options that are paid for in full or in part by the statutory health insurance.

We will show you which health insurance benefits you are entitled to at the dentist and which costs are covered by law. Basically, treatment is carried out according to medical necessity, but also from an economic point of view.

The best and most modern treatment methods are usually also expensive options. There is not always room for them in the benefits catalog of the statutory health insurance. If you have a private health insurance, it depends on your contract what is covered.

With private supplementary dental insurance, you can close the gap in the benefits provided by statutory health insurance and reduce your own contribution to the dentist to as little as 0 euros. The selection of the right tariff is crucial.

Important to know: According to the Social Security Code, your dentist must offer a health insurance benefit if he or she is licensed to do so. This is because people with statutory health insurance have a right to such treatment and it may not be refused. It doesn't matter whether it's a simple filling or a complicated root canal treatment - your dentist is obliged to inform you of the statutory health insurance benefits and treat you accordingly.

In addition, the dentist may then offer additional private medical services and bill you according to the private fee schedule for dentists. These additional services may be of the same or different nature.

Similar additional service: The treatment method corresponds to the standard treatment, but an additional service is added: for example, a tooth-colored veneer is added to the crown in the posterior region.

Different type of additional service: The treatment differs from the standard treatment, e.g. a gap between the teeth is treated with an implant instead of a bridge.

The dentist is also obligated to inform and advise you about all essential circumstances of the diagnosis or therapy. This includes, for example, the type and scope of a necessary measure and the associated risks of dental treatment.

You will find explicit regulations on this in §630 of the German Civil Code (BGB). The information also includes advice on the financial aspects of the treatment, i.e. also on the possible co-payment, e.g. for high-quality dentures.

Statutorily insured persons are entitled to a fixed allowance from the public health insurance fund for dental prostheses. The decisive factor is not the type of denture actually selected, but the dentist's findings in the treatment and cost plan. Depending on the findings, there is a medically necessary and financially economical standard provision. Since 01.10.2020, the health insurance company will pay 60 to 75 percent of this standard treatment in the form of a fixed allowance.

It does not matter whether you opt for this care option or want a higher-quality treatment by the dentist. The health insurance company always pays only the fixed allowance for dental prostheses. Anything above this standard treatment is billed privately and is your own contribution.

The standard treatment for dentures is usually a metal bridge in which the neighboring teeth are ground down. Many patients therefore opt for higher-quality treatment in the form of implantology. The treatment is gentler and does not damage neighboring teeth. However, the cost of dental implants is also many times higher than standard treatment.

Example: Cost coverage of the statutory health insurance for dental prosthesis.

Findings: Tooth gap in the posterior region (not visible).

| Treatment | Costs covered by health insurance | payment |

| Bridge without veneer (standard treatment) Costs e.g. 660 Euro | 60 percent 396 Euro | 40 percent 264 Euro |

| Ceramic implant Costs e.g. 3,000 Euro | fixed allowance for standard treatment 396 Euro | 80-90 percent 2.670 Euro |

The health insurance company pays up to 100 percent of the dentist's bill for fillings. It depends on whether you opt for the standard treatment or want a higher-quality filling in the color of your teeth. The health insurance covers amalgam fillings for posterior teeth and plastic fillings for anterior teeth.

If you decide to have a tooth-colored filling in the posterior region as well, this is a similar higher-quality restoration: The health insurance fund will cover the cost of the amalgam filling. The difference of 40 to 100 euros to the more expensive option is your own contribution.

Another form of private medical care is a so-called inlay, which is specially developed as a filling in the laboratory. It is made of gold or ceramic. The health insurance does not cover any additional costs for inlays; you receive the normal allowance for the filling. The co-payment for an inlay is between 300 and 600 euros. Our current recommendations for dental tariffs cover up to 90 percent of these treatment costs.

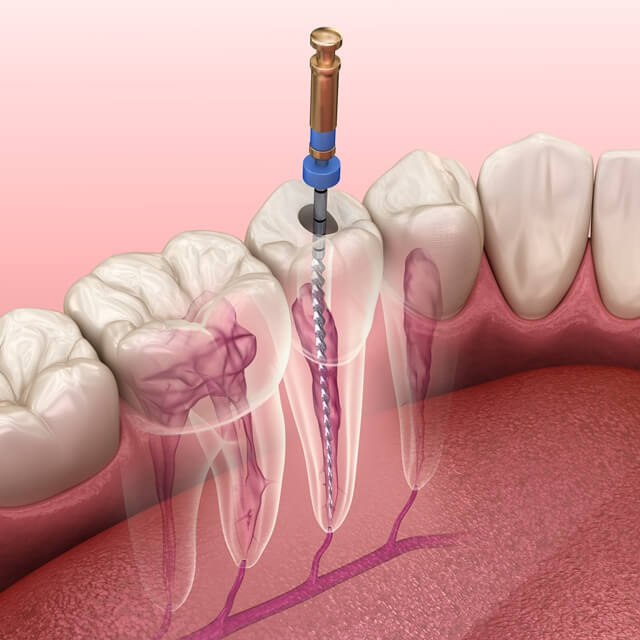

The health insurance company will pay up to 100 percent of the dentist's bill for an apicoectomy or root canal treatment. The decisive factor is whether the tooth is classified as worthy of preservation or not - because only then is it a health insurance benefit.

If the tooth is not classified as worthy of preservation, the treatments are 100 percent private benefits. In the case of private supplementary insurance, it is important that this covers the costs of root canal treatment even without SHI advance payment.

As with fillings and dentures, there are also different methods of root canal treatment. The health insurance company pays for the standard treatment, but the additional costs for a gentler or more modern method must be borne by the patient.

The most important preventive measure is the check-up at the dentist. This examination is covered by the health insurance once every six months. The dentist detects diseases at an early stage and can take measures in time. In addition, you increase your fixed cost allowance for dental prostheses through consistent preventive care and keeping a bonus booklet.

The health insurance also covers the costs of tartar removal once a year. Since 2004, periodontal screening has also been included in the benefits provided by the health insurance fund.

Professional dental cleaning (PZR), on the other hand, is not covered by the SHI benefits catalog and must be paid out of pocket. Dentists recommend that PZR be performed at least 1-2 times a year. A good supplementary dental insurance will cover the costs completely. There are also tariffs that cover up to 300 euros per year for bleaching.

In 2002, the so-called orthodontic indication groups - KIG for short - were introduced. Here, the malocclusion of the teeth is divided into degrees of severity. Levels KIG 3 to KIG 5 refer to "considerable impairment" in biting, chewing, speaking or breathing. In these levels, the costs of orthodontic treatment are covered by the statutory health insurance. However, 20 percent of the treatment must initially be paid by you as your own contribution. After successful treatment, this will be reimbursed.

The statutory health insurance does not pay for additional private medical services such as internal braces, colorless arches or other modern and aesthetic treatment options. Likewise, there is no cost coverage for braces of the health insurance in the KIG levels 1 and 2. For adults from the age of 18, there are only in a few exceptional cases benefits of the GKV.

It is therefore particularly advisable to have supplementary dental insurance for children, which covers the costs of additional lines and also pays for medically necessary measures in the event of a classification in KIG 1 and 2.

In principle, the statutory health insurance allows for a solid dental care. In many forms of therapy of the standard care, the health insurance benefits up to 100 percent, in dental prostheses about half. However, the keyword is standard care, i.e. medically necessary, simple and economical care.

If you want more and want to have access to modern, aesthetic treatment methods, you should think about private supplementary dental insurance in good time. Especially in the case of expensive dental prosthesis measures, e.g. with implants, the personal contribution can be significantly reduced in this way. We can help you find the best supplementary dental insurance for your individual needs.

ask the experts

Get to know us