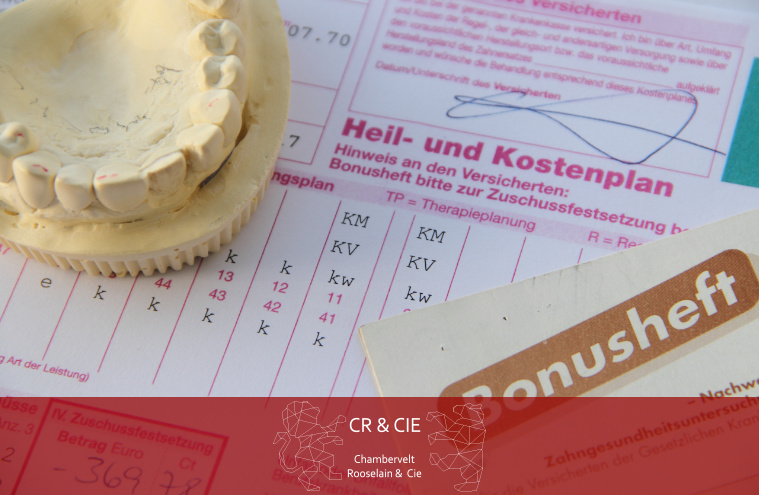

Are you currently undergoing treatment at the dentist? Once the dentist has issued the findings, you can (almost) no longer take out a dental plan. Supplementary dental insurance for ongoing or advised treatments is your only option. In this article, we'll show you the options with immediate coverage. Most of these plans are tailored to a very specific situation, e.g. for dentures. A professional consultation is recommended. Feel free to contact us, we will help you find the right tariff.

In Germany, normal supplementary dental insurance is only available to members of a statutory health insurance scheme. Those who have private health insurance cannot take out additional cover. The benefits for dental prosthesis and treatment are already included in the private health insurance.

Immediate protection applies to these treatments: Dental prosthesis

When does UKV make sense?: 1 to 3 missing teeth, treatment not yet started

Scope of benefits UKV High-quality dentures, e.g. implants

UKV DentalPRIVAT Premium - 25,92 Euro/month

UKV DentalPRIVAT Optimal - 13,75 Euro / month

Immediate coverage applies to these treatments: Dentures, dental treatment, fillings

When does the Bayersiche make sense? Treatment advised or already started, costs greater than 800 euros

Scope of benefits Bayerische ZahnSofort: 1,500 euros for advised / ongoing treatment spread over two years

The BavarianZAHN Smart + ZAHN Immediately - 44,90 Euro/month

The Bavarian ZAHN Prestige + ZAHN Immediately - 71,10 Euro/month

Immediate coverage applies to these treatments: Dentures

When does ERGO make sense? Dental prosthesis measure recommended or already started, fixed cost allowance GKV greater than 813.60 euros.

Scope of benefits ERGO ZEZ: Doubling of the fixed allowance of the GKV for dental prosthesis

ERGO ZEZ - 33,90 Euro/month

Immediate cover applies to these treatments: Orthodontics for children

When does ERGO make sense: orthodontic treatment for child advised or already started

Scope of benefits ERGO KFO Immediately: 50-75% for orthodontic treatment, 100% for prophylaxis, dentures and dental treatment

ERGO Orthodontics Immediate KFO

Many people first think about supplementary dental insurance when they go to the dentist for their first major dental treatment. The additional private medical measures for the treatment of a tooth gap with an implant are not covered by the statutory health insurance. The co-payment for a treatment quickly reaches 2,000 to 3,000 euros. For a root canal treatment, the co-payment is somewhat more favorable in the range of 200 to 1,000 euros.

Once the dentist makes a diagnosis, most 'normal' dental plans fall away as an option. At least if you want benefits for this dental procedure or root canal treatment. Only a few companies offer insurance coverage with cost absorption for this special case. ERGO with the tariff Zahn-Ersatz-Sofort, UKV / BBKK with the three tariffs ZahnPremium, ZahnOptimal and ZahnKompakt as well as Bayerische with the additional module "ZAHN Sofort" are your current options.

Due to the special situation, these dental insurances are not favorable for current and advised treatment. However, in many cases the tariffs are reasonable and worth their price. Each of the tariffs has its own peculiarities and is suitable for certain situations. Important for the selection of the appropriate dental insurance are:

Our tip: Call us: 0800 5565194 - We will advise you individually and without obligation about your options for advised and ongoing treatments.

1. advised treatment:

If your dentist or orthodontist has identified a specific need for treatment during a check-up and discussed this with you, this is already considered to be advised dental treatment. It is irrelevant whether or not a treatment and cost plan has already been drawn up for this specific treatment.

What is decisive is the patient file at the dentist's office. From this, the recommended treatment can also be derived later for the insurance company. Treatment is recommended if, for example:

Important: When taking out dental insurance, usually only those measures that have been diagnosed and discussed within the last two years are relevant. Before answering the health questions of a supplemental dental plan, speak with your dentist and review what is noted in the patient's record.

2. Ongoing treatment:

Once you have had your first treatment appointment with your dentist or orthodontist for a specific treatment and cost plan, the treatment is considered ongoing. Up to this point, it is advised. For the conclusion of a dental supplementary insurance, the beginning of the treatment is a decisive moment. The choice of tariffs is reduced again.

As a dental supplementary insurance for an ongoing treatment (if you want to include this measure in the insurance coverage) only the tariffs Zahn-Ersatz-Sofort of ERGO and all tariffs of the Bayerische Zahnzusatzversicherung with the additional module ZAHN Sofort remain. In this module, you will receive cost coverage of up to 1,500 euros for any type of treatment.

3. intended treatment:

Even if you have not yet seen a dentist, certain dental prosthesis measures or dental treatment may be planned or intended. This is the case if it is obvious to you that you will need or want to visit the dentist in the near future due to a measure. For example, this applies if

Our tip: Before taking out dental insurance, contact us on 0800 5565194. We will explain all the tariff details to you in detail and help you fill in the health questions.

Until 10/2021, there was no supplementary dental insurance for ongoing / advised measures for every situation. The insurance companies selected here again after the kind of the dental treatment and/or measure with the dentist. Only treatment related to dentures, i.e. bridges, implants, crowns and prostheses, could be insured. With the introduction of the Bayerische ZAHN Sofort tariff module, other measures such as root canal treatments and fillings can also be insured retrospectively.

Supplementary dental insurance can be taken out retrospectively for:

The following cannot be insured:

What you should avoid at all costs is taking out supplementary dental insurance and concealing ongoing or advised treatment when making an application. You are obliged to provide truthful information when you apply for dental insurance.

The verification of your information will take place no later than the first major dental bill. The insurance company will then ask to see the dentist's patient file. There, it is easy to see whether treatment was already advised or ongoing at the time the insurance was initiated. In other words, whether there were any findings. In the worst case, you will be threatened with cancellation by the insurance company. You will not receive any benefits and your premiums paid up to that point will be lost. These consequences can occur in the event of a breach of obligation:

It is important to choose the right tariff for an existing or contemplated dental treatment. Due to the media awareness through TV commercials, we often receive inquiries about the ERGO ZEZ tariff. But is this tariff always the best choice? Certainly not. On the contrary: this supplementary dental insurance only makes sense for a very special situation. You have just received a treatment and cost plan for dentures from your dentist and the fixed allowance of the GKV exceeds 814 euros.

If the GKV only subsidizes 300 euros for the dental prosthesis or if it is a filling, root canal treatment or an orthodontic measure, this tariff is the wrong choice. Even in the case of a fixed allowance above 814 euros, ERGO is not necessarily the most sensible choice. Under certain circumstances, the tariffs of UKV or SDK may be more suitable for you, as the reimbursement may be higher. Therefore, before taking out supplementary dental insurance for current or recommended treatments, we always recommend a professional consultation. This is the only way to ensure that you will receive what you expect from the insurance. Feel free to call us, we will help you with your decision.

Supplementary dental insurance without health questions means that the previously described case of a breach of the duty of disclosure cannot occur. There is no health check when you apply and you are guaranteed to be accepted by the insurance company - regardless of your current dental health. You can take out this supplementary dental insurance at a later date, even if you are currently undergoing a procedure at the dentist.

However, these plans generally exclude coverage for advised or ongoing treatment. Missing teeth cannot be covered. The insurance cover only includes future diagnoses.

Our tip: Dental insurance without health questions is an excellent alternative if your ongoing / advised treatment is no longer insurable or the price-performance ratio does not justify taking out the somewhat more expensive tariffs.

In the table you will find our recommendation when which supplementary dental insurance fits best.

| Type of treatment | Our recommendation | |

| Advised denture | expensive/expensive | tariff with benefit for dental prosthesis measures: UKV dental insurance BBKK dental insurance ERGO ZEZ dental prosthesis immediately Bavarian dental insurance |

| cheap/short | Dental insurance without health questions: Nürnberger Dental Insurance Deutsche Familienversicherung Dental Insurance Münchener Verein Premium uniVersa dent|Private R+V dental insurance ERGO dental insurance (advised treatments are excluded - coverage for future risks) | |

| Ongoing dental prosthesis | expensive/expensive | tariff with benefit for dental prosthesis measures: ERGO ZEZ Dental Immediate Bavarian dental insurance |

| cheap/short | dental insurance without health questions: Nürnberger Zahnversicherung Deutsche Familienversicherung dental insurance Münchener Verein Premium uniVersa dent|Private R+V dental insurance ERGO dental insurance (advised treatments are excluded - coverage for future risks) | |

| Advised or ongoing treatments (e.g. root canal treatment) | expensive/expensive | tariff with benefits for dental treatment: Bavarian dental insurance |

| cheap/short | Dental insurance without health questions: Nürnberger Zahnversicherung Deutsche Familienversicherung dental insurance Münchener Verein Premium uniVersa dent|Private R+V dental insurance ERGO dental insurance (advised treatments are excluded - coverage for future risks) |

If you have been advised to have dentures or dental treatment, or are already undergoing ongoing dental procedures, your options are very limited. Dental insurance with immediate coverage for these diagnoses is the only way to get coverage. Whether the insurance is worthwhile depends on the individual diagnosis and the existing treatment and cost plan.

We recommend that you consult an expert who will explain the advantages and disadvantages of this special insurance solution in detail. Give us a call. Our consultation is free of charge and without obligation.

ask the experts

Get to know us