Taxes are a big part of Germany and therefore they must be taken extremely seriously, as in most countries. For future expats or people who have already work in Germany, the topic of taxes can raise many questions. It is not uncommon for expats to find themselves facing many problems, and often it is not even possible to know where best to start.

There are many taxes in Germany. Among them are taxes on food. If you buy beer, coffee, tobacco or sparkling wine in Germany, you will have to pay different taxes. However, unlike in some other countries, these are already noted in the price itself.

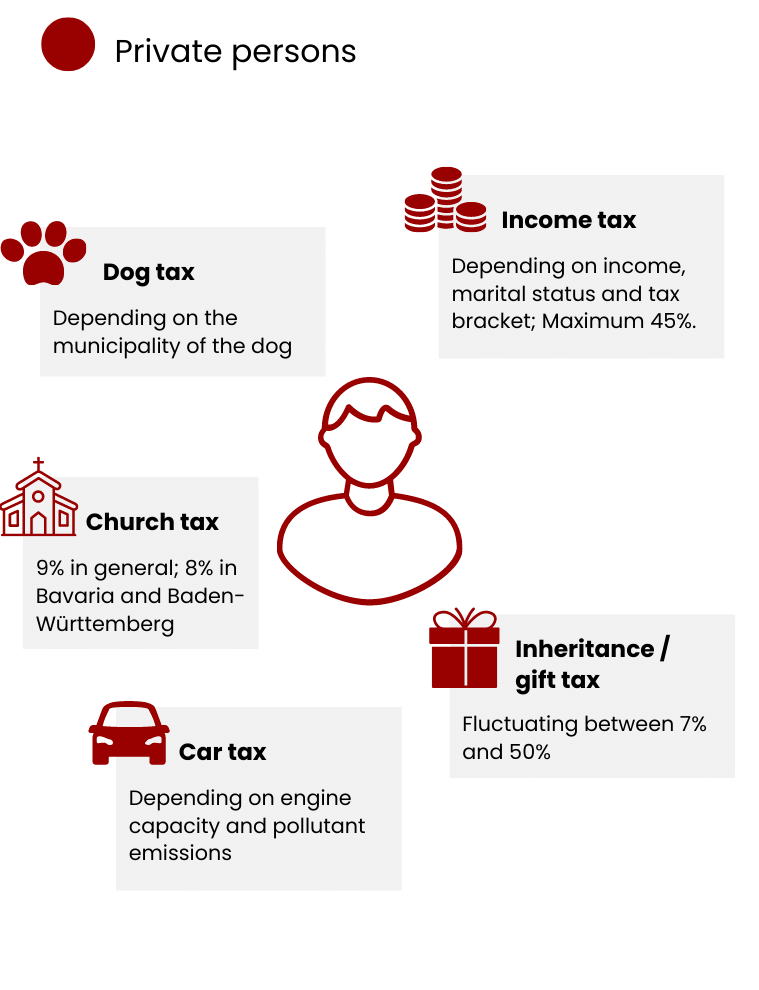

This means that you do not have to add the corresponding taxes to the purchase price. Also in the area of entertainment there are some taxes you should consider. Do you have a dog or even several? Then a certain tax is due depending on the municipality. Also interesting: The breed of the dog plays a role in the tax collection in some cases.

If you belong to a church association, you pay a church tax in Germany. This applies to both Catholic and “Evangelische” church members. In addition, there are many other areas that are taxed. Racing bets and lotteries are taxed, as are casinos. The so-called amusement tax also states, for example, that admission to events must be taxed.

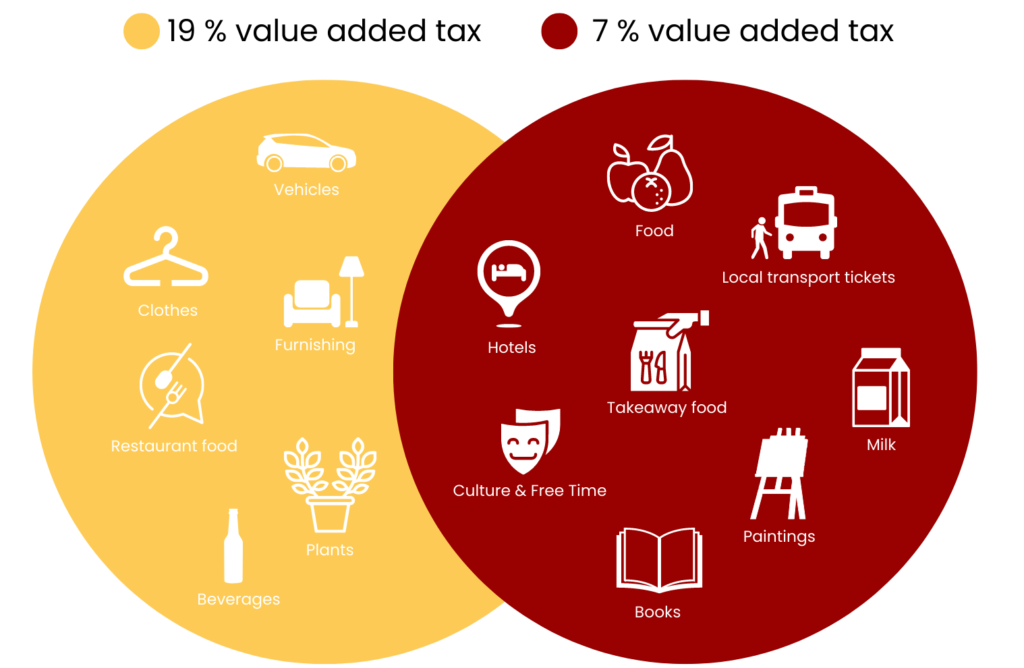

Value added tax is a tax on consumers. This is to be paid by the end consumer when purchasing products or services. Thus, as a customer, you pay the gross price when purchasing a product or service.

If you have to write an invoice for your own customers for professional reasons, you are obligated in Germany to hand over a receipt to the customer. In addition, you must keep a so-called VAT statement (Mehrwertsteuerbescheinigung). This means that for both cash payments and bank transfers, your issued invoice must show the VAT rate and tax amount in addition to the cost of the product or service.

The corresponding input tax deduction creates the possibility for entrepreneurs to offset certain prepaid taxes against the respective VAT. Through this methodology, the end consumer pays the VAT and the business is not charged additionally or twice.

As a rule, the 19% tax rate applies to any sales that are subject to taxes. In Germany, goods for daily use are taxed at only 7%. This is a reduced rate of value added tax (ermäßigte Mehrwertsteuer). This applies, for example, to basic food such as bread or milk. Events in the media and art sectors are also subject to the reduced VAT rate. The same applies to public transport, such as buses and trains, and products whose sales are related to copyright law. Examples include books, films and broadcasting fees.

Another, quite important type of tax, is the income tax (Einkommensteuer). As the name suggests, this is the tax on your individual income, i.e. your salary. The German income tax system is progressive. A higher marginal tax rate is calculated for the higher part of the income in each case. The higher the income, the more the average tax rate approaches the marginal tax rate of 42 per cent.

If you are a classic employee, you pay a monthly income tax. This is automatically deducted from your salary. In this case, you do not have to file a typical tax return. However, there are a few exceptions. For example, if you have other sources of income in addition to your main income, such as a short-time worker. If this additional income exceeds 410€, you also have to file a tax return.

Even if you are still a trainee or student, you have to pay your taxes. The tax allowance is currently 9,744€ gross (in the tax year). If this amount is exceeded, everyone permanent employees and part-time employees, students, etc. must pay. In some cases, you may not be required to file an income tax return. However, there are a few situations in which a voluntary income tax return in Germany is appropriate.

With the help of the taxable income and the individual tax class (there are a total of six different tax classes in Germany), you can easily determine your tax burden with an online calculator. In addition, there is a so-called top tax rate (Spitzensteuersatz). This is currently at 42%. If you receive an annual income of €58,597, this top tax rate takes effect to serve as a brake on infinitely high taxes. All the money above this limit must be taxed at 42%. But watch out: In the case of married couples, twice the value of €117,194 applies as the limit.

The idea behind the progressive tax system is that low-income earners have a lower tax rate than people with high incomes.

Of course, there are quite a few more taxes to consider in Germany. For the sake of simplicity, we will summarize them compactly so that you can get a rough overview. All of the taxes listed are related to everyday activities that may affect you to a greater or lesser extent.

Inheritance and gift taxes are also of particular interest. Because as soon as you receive money (assets) as a gift, the transfer of assets that has taken place is taxed. Therefore the big house or massive inheritance can quickly become a “tax shock”.

Emigrating to Germany is only half the fun if you are without a car. Granted, in large cities with subways, buses and trams (S-Bahn), you don't necessarily need a car, yet many people in Germany choose to do so because having their own vehicle brings so much convenience.

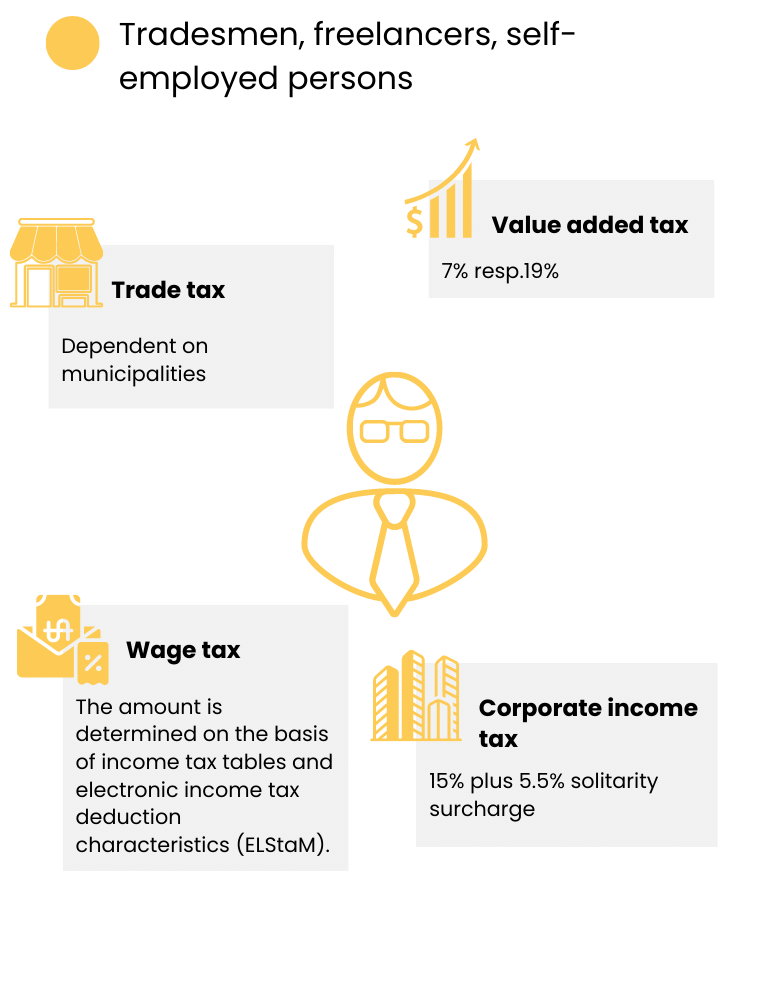

If you have traveled or emigrated to Germany to continue your self-employment, you will of course be subject to certain taxes. Unfortunately, Germany does not make it easy for the self-employed in many areas. So if you feel overwhelmed by the information at first, you are certainly not alone.

After all, there are a number of different things you should be aware of when it comes to self-employment taxes in Germany.

It is important that you know basic information for tax contexts, otherwise it will be difficult for you to understand the tax and its composition. Ideally, you should deal with the German tax before you become self-employed, in order to prevent annoyances and avoid nasty surprises.

You need to understand that if you submit incorrect information, you can expect not only financial penalties or reminders. Your business will also attract negative attention and will probably be inspected more often or more intensively by the tax office. For clarity and security in self-employment as an expatriate in Germany, you should therefore pay close attention to taxes.

Depending on the type of self-employment, different taxes are due. In the case of a GmbH, for example, one is subject to corporate income tax. In addition, certain purchases for the business or the self-employed work can be deducted from the tax. Here, too, it can be interesting to inform yourself in advance. In any case, keep the receipts for certain purchases, such as a new laptop. In this way, you can also deduct a business meal, among other things, provided you still have the invoice.

In addition to corporate income tax, the self-employed must also pay income tax. For single people this amounts to 9,000€, for married couples it is 18,000€. If you work as a self-employed person in your trade, a trade tax is due. Freelancers do not have to pay this, but of course they are still obliged to pay income tax.

If you have emigrated and employed people, you also have to pay income tax for these employees. Especially if you are above the 9.000€ with the salary, it makes sense to get a tax consultant and/or a financial advisor for support. In some areas, they also offer help in English, if you still feel uncomfortable with the German terminology.

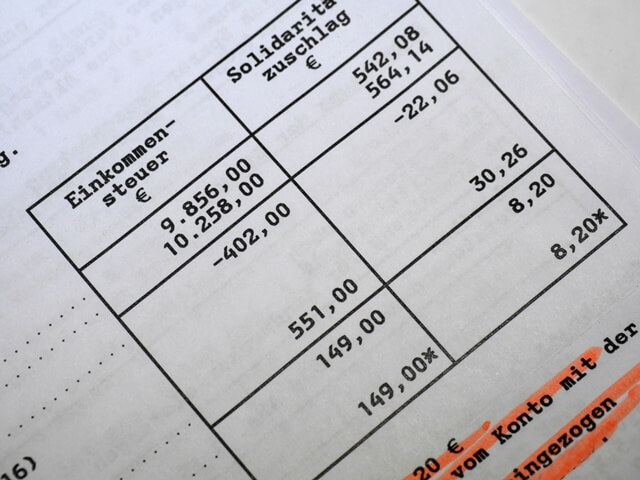

Since 2021, only certain groups have to pay the solidarity surcharge (Solidaritätszuschlag). The so-called Soli will thus be paid by high earners, investors (with exhausted savings allowance), limited liability companies and other corporations.

This means that about 90% of all taxpayers, i.e. a considerable part of all taxpayers, do not have to pay the Soli anymore. If you have to pay the Soli due to the above mentioned groups, it is added to the classic income, wage and capital gains taxes.

In total it is 5.5%. Your employer deducts the solidarity surcharge directly from your salary. The amount of the solidarity surcharge to be paid is stated on your income tax assessment notice.

As an expatriate in Germany who does not have a domicile or habitual residence in Germany, you are only subject to limited tax liability.

If you stay in Germany for more than six months, you become liable to pay taxes. Even if the limited tax liability sounds very positive at first, there are also some other aspects that need to be mentioned. Here it is namely so that with a limited tax liability also some advantages remain away.

For example, there is no basic tax-free amount. As a result, you have to pay taxes even on very low amounts, which quickly turns out to be not very worthwhile. There are no tax allowances for children, and you are not entitled to any relief for single parents either.

The topic of taxes in Germany may seem quite confusing at first, but if you deal with it in detail, you will quickly understand what the German bureaucracy is all about. Certain basics are important and must be adhered to. If you have any questions, you can of course always contact the relevant office (tax office - Finanzamt, etc.) yourself.

ask the experts

Get to know us