insurance broker

Know how insurances work in Germany

Most so-called financial advisers in Germany are not insurance brokers but actually tied agents and consequently foremost sales personnel!

Expats, especially those from the UK, Ireland, or the US, where the financial advice market is strongly regulated, are often shocked when they find that they have become an easy victim of hard-selling German insurance agents, or „Finanzberater“.

This is in part due to the long-standing reluctance of the German government to implement tough regulation on financial advice. If you believe that someone who is advising you on an insurance or pension plan in Germany will generally have your best interest in mind (as a financial adviser at home would), you can sometimes find yourself to be sorely mistaken.

Below you’ll find a video that explains the difference between the insurance advisors in Germany and why going with an insurance broker or insurance consultant might be your best choice. If you rather read some info, scroll down for more details and explanations.

What is the difference between an insurance agent and a broker?

Generally speaking, before you buy an insurance, you need to understand the difference between the three types of financial advisers in Germany. You need to be able to determine the reliability of an adviser in the first few minutes of a meeting.

All financial advisers have to disclose this information right from the start when offering insurance advice – failure to do so is punishable by law, and also a sure sign you should go ahead and leave. No trustworthy adviser will fail to disclose his or her status.

First off, you should find out which of these three categories your potential adviser falls into:

Independent financial adviser

Both can advise you on products from the whole of the market. And both have to advise you based on the „best advice“principle, and can be held liable if failing to set you up with the best solution for your particular needs. Consultants and brokers are representing your best interest towards insurance companies and banks.

The main difference is that the consultant is entirely paid by fees directly from you whereas the broker usually receives a commission from the insurance companies, but can also work for you based on fees if so agreed.

Multi-tied adviser (German: Mehrfachagent)

Most large financial distribution organizations in Germany belong to this group. These advisers can only advise you on products from a limited range, preselected by the organization to which they are tied, though they are still obligated to choose and recommend the most suitable products from this diminished selection.

Therefore, the multi-tied agent still represents multiple insurers first and foremost. The company they work for will often limit the selection to only those insurance companies which offer them the highest commission.

Tied adviser (German: Gebundener Vertreter)

This group of advisers can only recommend the products of one company to which they are tied, usually by direct employment. There is no such thing as an “independent agent”, because the agent represents directly the insurance company he works for.

Tied agents can have an important role in the market as they can offer specialized services, such as direct claims settlement. You always have to be aware, however, of the limitations in what they offer to you and know that they are not representing your own best interests but those of their company.

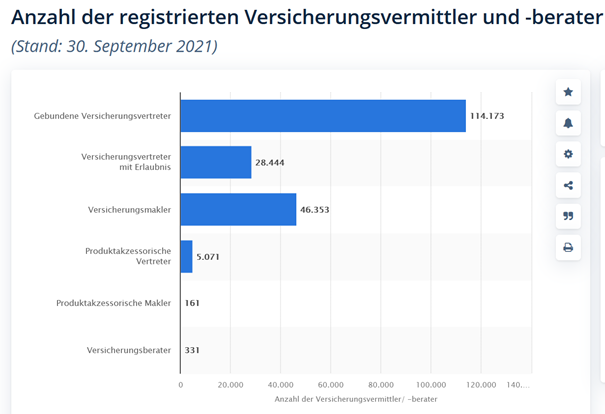

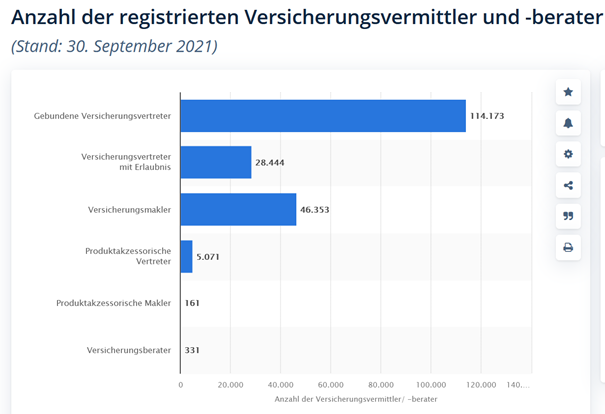

How many tied agents, broker and consultants are active in Germany?

You can see in this graph that the vast majority of insurance intermediaries in Germany are tied and multi-tied agents (around 147.688 per 09/2021), followed by only 46.353 insurance broker all over Germany. The number of insurance consultants is even much smaller with only 313 in all of Germany. The concept of fee-based insurance advice somehow has not really taken hold in Germany so far.

How many tied agents, broker and consultants are active in Germany?

An insurance broker arranges insurance contracts between insurance companies and policyholders. He exclusively represents the interests of the customer (usually the policyholder), whereby his tasks lie in the provision of advice as well as the procurement, arrangement and handling of insurance cover.

This includes suggesting appropriate offers to the customer and warning him of recognizable risks. In addition, his general duty to advise includes explaining to the customer which risks he should cover, how to achieve the most effective risk coverage, with which insurer this coverage is possible - and at what cost.

"The customer is king!" This also applies in the brokerage business. The policyholder (clilent) has a right to issue instructions. The wishes of the customer must be given due consideration by the insurance broker. In this context, the broker is allowed to deviate from instructions of his client that are contrary to the client's interests and based on a lack of expertise in favor of the policyholder.

The broker is also obliged to select a suitable insurer. This includes that he obtains concrete offers, which he conscientiously examines and compares. This concerns both the selection of the insurer and the terms and conditions in detail. The selected insurer must be solvent and have an appropriate license to do business.

Furthermore, the insurance broker must ensure that the insurance coverage is comprehensive. He is the guarantor of the insurance coverage!

Is it better to buy insurance through a broker in Germany?

If you like to be sure that your advisor has only your best interest at the core of the advise process, selection the most suitable

insurance coverage for you from the market: then yes, it is better.

It is usually neither more expensive nor cheaper to use a broker for any types of insurance because commissions to be paid out either to agents or to broker are computed generally into the premiums.

Since the market is pretty competitive, there is no measurable difference in the standard premiums regardless whether you go directly to an insurance company through their tied agents or indirectly through an insurance broker.

What we can offer you as your insurance broker for Expats

We at Chambervelt, Rooselain & Cie. are licensed and registered as truly independent brokers and financial advisers. We are in no way bound to any insurance company, bank, or financial sales organization. You can find all our license and permit information here at the Imprint-section of this website and you can validate this info in the national online registry here.

We are also specialist for Expats in Germany. Expats need specialized advisers in order to get the best possible advice. The usual German adviser from a bank, insurance company or financial distribution company (most often pyramid-structured) may speak decent enough English – but that is not enough in order to advise Expats properly.

A good adviser needs to know the many traps, loopholes and backdoors in insurance contracts. A good adviser needs to understand the process, in particular when an Expat may be planning on living in Germany for only a few years. This plays a huge role when selecting pension or investment plans, as the reduction of initial costs is crucial for Expats to profit from tax breaks and other subsidies.

A good adviser also has to understand where their client comes from and what the insurance and pensions systems are like there. Try and ask an average German adviser about how to deal with your 401k (if you are from the US) or about a

QROPS transfer (UK) and you will be met with nothing but blank stares.

Premium variations for families and companies

Especially with insurance that covers different areas of life, it is important that the insurance protection can be adjusted to one’s personal situation. Therefore, couples who are married or cohabiting can take out a joint family legal expenses insurance policy. Unmarried children also benefit under certain conditions from family legal expenses insurance until they turn 25.

Tradesmen, entrepreneurs and freelancers gain legal and financial support in disputes related to their professional work with business legal expenses insurance. This insurance can be taken out not only for individuals but also for entire businesses.

To sum up

Working with an insurance broker in Germany

Since the

German health insurance system is unique in the world, and often highly confusing, it is also important to know, as an adviser, how the NHS in the UK functions or the state insurance in other EU-member states, for instance, in order to explain the differences in the German system properly and help the client make the right choice.

For instance, if you sign up with a

private German health insurance you need to know that by doing so you opt out of the

German public health insurance system entirely and, most likely, indefinitely. People coming out of national health systems, which cover every resident, usually fail to understand (or are not properly informed) that private insurance in Germany acts as a substitute for public insurance and not as a supplement on top of the state system as in most other countries with a public health system. Without the right information, you could wake up one day from this misconception with a nasty surprise. If your circumstances change and you decide you would rather have public health insurance in Germany, you might find out that, due to poor advice, you can’t.

Expats in Germany need advice from experts – and we are the experts for expats in Germany, for insurance,

investment and

pension planning.

If you have questions about our work, or about some financial advice you have received from others, you can use our Contact form below. We will be happy to explain things in more detail to you, or provide you with an unbiased second opinion. We will be happy to explain things in more detail to you, or provide you with an unbiased second opinion.