as a dog owner, you can rely on your furry companion: He is faithful at your side and goes with you through thick and thin. But don't forget: no matter how well-behaved and friendly your dog is, it can always get frightened and run away, causing a traffic accident or injuring a fellow dog while playing.

For you as a dog owner, this can be expensive. Opt for dog liability insurance to be protected from high costs. Find out now what dog liability insurance is, when it covers you and in which federal states it is mandatory.

Section 833 of the German Civil Code stipulates that pet owners must pay for all damage caused by their pet. For you, this means: If your dog gets loose and causes a traffic accident or injures a person while playing in a storm, you have to pay for all damages. If, for example, several cars are damaged in an accident or a person is injured, you may be faced with high claims for damages.

Your dog owner liability insurance protects you from such claims for damages by third parties and compensates them for you. It also fends off unjustified claims that third parties make against you.

Taking out dog owner liability insurance primarily protects your assets. In addition, it guarantees that third parties who suffer damage from your pet will be compensated for it. For the latter reason in particular, dog liability insurance is a legal requirement in many German states.

Damage caused by dogs can be expensive for the owner. Accordingly, liability insurance for dogs makes sense for anyone who keeps a dog as a pet. In addition, insurance for dog owners is even required by law in the following federal states:

There is no compulsory insurance at all in Mecklenburg-Western Pomerania.

Injuries to animals and people and minor personal injuries account for over 65 percent of all damages.

Liability insurance for your dog covers these damages. Most insurers provide the following benefits:

If the claims of third parties against you as the dog owner are unjustified, the insurer will defend you against them. In case of emergency, the dog liability insurance even covers court and lawyer fees.

You can take out liability insurance for your dog with many insurers for as little as 2.50 euros per month. However, it is not possible to say in general what the insurance will cost you in a specific case. After all, the exact costs depend on:

With many insurers, you have the option of taking out dog liability insurance for all breeds of dog. However, there are insurers that do not offer coverage for dogs that are considered dangerous. These can be the following breeds, for example:

Have you ever thought about a possible occupational disability? No longer being able to practice your profession sounds unlikely - but it's an underestimated risk: According to the German Insurance Association (GDV), one in four people in Germany can no longer practice their profession before retirement due to physical or mental ailments. If an occupational disability occurs, the state benefits are not enough to secure your standard of living and avoid financial problems. In this article, I explain how occupational disability insurance protects you and whether you need it.

Your occupational disability insurance (also known as BU, BUV or BU insurance) pays you a monthly pension if you can no longer pursue your current profession for health reasons. In this context, occupational disability is defined as being unable to work in your last profession for at least six months. Lifelong occupational disability is not required in order to receive insurance benefits.

For the insurance to pay benefits, the occupational disability must not only last at least six months. It must also meet the so-called 50 percent rule. This means that the insurance company only pays the agreed occupational disability pension if you have lost at least 50 percent of your ability to work and can no longer perform at least half of your previous occupational activities.

Mental health problems, a slipped disc or a cancer diagnosis - there are many illnesses that prevent you from doing your job. If you have to forego all or part of your income due to this stroke of fate, things can get dicey financially.

If you have taken out occupational disability insurance, you need not worry about your financial future: Your occupational disability insurance will pay out regardless of the reason for your incapacity. You will receive your cash pension for as long as your occupational disability lasts. If you are permanently unable to work in your profession, you will receive benefits up to a contractually agreed age limit.

Occupational disability can affect anyone. This becomes particularly clear when you consider that illnesses are usually the reason for occupational disability. Accidents, on the other hand, trigger occupational disability far less frequently. The most common reasons for receiving an occupational disability pension are these:

Occupational disability insurance makes sense for you if you are financially dependent on your income. This is the case for the vast majority of working people - a private occupational disability insurance is therefore one of the most sensible insurances. I recommend it to all my clients.

No matter if you are self-employed, employed, an apprentice, a beginner or very experienced in your job - if you don't have a substantial fortune to fall back on, an occupational disability insurance is a sensible investment for you. This becomes clear when you consider the following:

If you start your career at the age of 25 and earn a gross income of 3,000 euros, you will earn 1,512,000 euros by the time you retire. Your labor is therefore your most valuable asset. If it fails due to an illness or accident, only very few people have the financial reserves to compensate for this loss. In comparison: Your car is worth 60,000 euros - your comprehensive insurance covers all damages. This means that your car is often better protected than your labor, which is many times more valuable.

If you are a civil servant, you are entitled to a pension in the event of occupational disability. Only if your entitlement to a pension is less than your cost of living, you should think about a disability insurance (a BU for civil servants). If you are a civil servant on probation or revocation, a disability insurance also makes sense. After all, you are not yet entitled to a pension.

It is not possible to say in general what your occupational disability insurance will cost. After all, the premiums depend on several factors. The following points influence the amount of the premium:

Your age when you take out the insurance policy

If you take out occupational disability insurance at an early stage (for example, in your 20s during your studies), you will benefit from lower premiums. The amount of the occupational disability pension you agree upon depends on your current costs. The pension should be sufficient to provide you with an adequate standard of living if you lose your income from work.

Are you thinking about saving the monthly costs for an occupational disability insurance? You are not alone with this thought. However, there are hardly any real alternatives to occupational disability insurance. The following options come into question:

The statutory pension for reduced earning capacity as an alternative to occupational disability insurance

Provided you have paid into the statutory pension insurance for at least 36 months in the last five years, you will receive a state pension in the event of occupational disability. However, please keep in mind: In 2021, this statutory pension for reduced earning capacity averaged only 877 euros per month. For the vast majority of people, this amount is not enough to cover their running costs.

It is also important to know that you will only receive a reduced earning capacity pension if you are unable to work at least three hours a day in any profession. If you currently work as a department manager, for example, you will not be eligible for a reduced earning capacity pension if your health problems mean that you could work in another job with lower pay. The statutory pension for reduced earning capacity is therefore only an alternative to occupational disability in a few cases.

You've already toyed with the idea of saving the premium for an occupational disability insurance policy and putting it aside yourself in the event of an occupational disability. The idea seems tempting, but it only works if you become disabled towards the end of your working life. If you can no longer work at a younger age, your savings will not be enough to compensate for the loss of your income.

Also, keep in mind that the financial damage caused by the loss of your earned income is immense. Even if you can cover your living expenses from savings, there is often not enough money left over to build up reserves for bad times or old age.

Here is an example:

If you become incapacitated at the age of 53, you still have 14 years until retirement. To bridge the time and have 2,000 euros available each month, you need 336,000 euros in savings. At the same time, you no longer pay into the pension fund due to your occupational disability. This reduces your future pension payments. You also have to compensate for this loss with savings.

Before you take out an occupational disability insurance policy, remember to compare the offers of different providers. Pay attention to the following important points:

Set the amount of your disability pension so that you can cover all your running costs. The running costs include your expenses for housing, the maintenance of your family, food and insurance. I recommend that you choose an annuity that is equal to 80 percent of your net income.

In the event of occupational disability, it is important to have a reliable insurer who will pay you an occupational disability pension quickly and reliably. You can find help in selecting a suitable provider from your insurance broker or here.

There are two types of insurance that make sense to take out in addition to occupational disability insurance: legal protection insurance and daily sickness benefits.

If your occupational disability lasts longer, your pension must still be sufficient to live on in 20 years or more. I recommend choosing a tariff where the pension amount can be adjusted at a later date. That way, you can ensure that your disability pension will be sufficient if your circumstances change and the cost of living increases over time.

Some occupational disability tariffs provide for the insurer to refuse to pay the pension if you are able to work in a profession other than your current one - this procedure is called "abstract referral". It does not matter whether you actually find such a job. For you as the insured, the abstract referral represents a risk. Make sure that your tariff does not contain such a clause so that you are not left without a job and money in the event of occupational disability.

If your occupational disability lasts longer, your pension must still be sufficient to live on in 20 or more years. I recommend choosing a tariff where the pension amount can be adjusted at a later date. That way, you can be sure that your disability pension will be sufficient if your circumstances change and the cost of living increases over time.

The German healthcare system is considered one of the best in the world: as a citizen in Germany, you enjoy excellent medical care as well as financial coverage in case of sick leave and nursing care. Executives and professionals from foreign companies working in Germany benefit from expatriate health insurance in Germany. Everything you need to know about the topic is presented here.

A longer stay abroad has become part of everyday life for many people today - whether for a work & travel year, as a temporary employee in Germany or even as a visiting scientist. If you are a foreigner working in Germany for a longer period of time, it is important that you have reliable insurance coverage. This is the only way to ensure that you will get the medical treatment you need in case of an emergency - without having to pay expensive costs out of your own pocket.

Both for foreign expats who come to Germany for a longer period of time and for German expats abroad, there are special tariffs offered by the insurance companies. The scope of benefits can be individually adjusted for many tariffs.

The costs for medical treatment, a stay in hospital or even for medication are paid by the health insurance companies in Germany. If you move permanently to Germany, you can either take out health insurance through your employer or choose your own insurance. You can choose between public and private health insurance. If something happens to you as an expat in Germany, you will receive medical care in any case. This happens in case of emergency even if you do not have insurance status. You can still pay for the treatment afterwards - but this will be out of your own pocket if you do not have health insurance for expats. For this reason, the law requires that foreigners who live and work permanently in Germany have health insurance. The insurance also saves you from high medical bills.

For expats with a temporary stay of two or three years, on the other hand, a temporary expat insurance is the right thing, which works like a long-term health insurance.

If you take up a job in Germany, you are usually also subject to compulsory social insurance. This means that you, as an employee, pay contributions from your gross salary to pension, nursing care and accident insurance as well as to unemployment and health insurance. As a rule, all domestic and foreign employees are subject to social insurance and must pay the corresponding contributions.

However, there are exceptions: Foreign employees are not covered by German social security law if they are

Expatriates who do not have their permanent residence in Germany, but who stay here for several years, can take out special health insurance for expatriates. This is usually valid for up to five years.

If you have a temporary residence permit in Germany, you must present proof of valid health insurance both when entering the country and when extending your visa. The following criteria are decisive:

Almost 90 percent of citizens in Germany have statutory health insurance. Both people from other EU countries and non-EU citizens from third countries can take out statutory health insurance in Germany at any time. Trainees, skilled workers or even trainees who are employed by companies as expats in Germany and earn no more than 62,550 euros per year are covered by the public health system. Spouses, cohabitants and children up to and including the age of 25 can in some cases be covered by family insurance, provided their income is less than 450 euros per month.

If you would like to take out statutory health insurance as an expat in Germany, there are almost 100 health insurance companies available to you. The statutory health insurance offers you all medically necessary benefits in case of illness. This includes both outpatient treatment by statutory health insurance physicians as well as hospital stays and treatment by a dentist.

If you are sick for more than six weeks, the health insurance fund will step in after the sixth week and take over your salary payment: You will then still receive 70 percent of your previous salary. Within 36 months, you can claim this payment for a maximum of 78 weeks.

If you would like to take out statutory health insurance, simply contact the health insurance company of your choice. They will then issue you with a health insurance card, which you can use to be treated by a panel doctor of your choice.

If you would like to take out private health insurance as an expat in Germany, you can choose from over 40 private health insurance companies. These offer you different ranges of benefits, which is why we recommend a detailed comparison in advance.

If you have private health insurance, you will enjoy higher quality and more comprehensive medical care. This is particularly advantageous for you as an expat in Germany: For example, you can request a doctor who speaks English, Spanish or another language in which you can communicate better.

Another advantage is that you can claim up to 80 percent of the insurance costs as a privately insured person against tax.

However, not every expat in Germany is eligible for private insurance: If your annual salary is less than 62,550 euros, you can only take out statutory insurance.

As an expat in Germany, you can become a member of a PKV under the following conditions:

Especially as a young expat with no special medical history and a good income, you will benefit from switching to a private health insurance. You are usually insured for at least 18 months and can change the policy with a notice period of two months before the end of the first 18 months or in case of a premium increase.

The calculation of the contribution amount in the statutory health insurance is always based on your income. With private health insurance, this is different: Here, your medical history, your age and other factors play a role in the premium calculation.

If you want to take out private health insurance as an expat in Germany, you first pay a doctor's bill out of your own pocket and then submit the bill to the health insurance company. After a few weeks, the amount will be reimbursed. This means that you have to pay in advance, but in contrast to the statutory health insurance, you will be reimbursed 100 percent of the costs.

If you have to assert your rights in court or with the help of a lawyer, your legal protection insurance will cover the costs incurred. This way you can face legal disputes with your landlord, employer or authorities more calmly. Here we show you which costs are covered by legal protection insurance and whether the insurance is worthwhile for you.

Your legal expenses insurance covers the costs of legal proceedings in and out of court. This means that it covers your legal fees if you are represented in court or out of court. It also pays for costs incurred around a court case and covers your costs if you lose in court.

Keep in mind: Your insurance does not cover all legal costs. Rather, costs are only covered in the legal areas covered by your tariff.

If there is a dispute in court, high costs will be incurred. If you lose in court, for example, in connection with an eviction action due to owner-occupancy, you will incur court and attorney fees of around 4,000 euros (depending on the amount in dispute). If you lose the case, you have to bear these costs yourself - every legal dispute therefore involves a certain cost risk for you. Legal protection insurance helps you to exercise your rights with peace of mind.

In the insured areas of law, the insurance covers not only the necessary legal fees, but also

The costs incurred will be paid by the insurance company in full or up to an agreed maximum amount. If a maximum sum is agreed upon, it is often between 3,000 and 6,000 euros per year or per claim. In addition, most insurers offer you the option of receiving advice from legal experts by telephone. The hotlines are usually available around the clock.

If you take out legal protection insurance, you are not only assured of competent legal advice. You also have the opportunity to enforce your rights in court without having to fear the financial risks of a lawsuit.

Your legal protection insurance covers costs related to legal disputes in the legal areas covered by your insurance tariff. The most important areas for which you can take out insurance are: Professional legal protection, private legal protection and traffic legal protection.

Whether legal protection insurance is worthwhile for you depends on your individual situation. Therefore, ask yourself whether and in which areas of your life you could face legal trouble. Do you drive your car every day or are you threatened by legal disputes around your workplace? Then it may make sense to take out traffic or employment legal protection. If, on the other hand, you don't own a car and have a secure job and a fair employer, insurance coverage is less worthwhile.

How useful legal protection insurance is for you also depends on how likely you think it is that you will need a lawyer or have to go to court. The more likely this is, the more urgently you need legal protection insurance.

Your legal protection insurance reimburses the costs of contractually agreed disputes. Nevertheless, it is not an all-round carefree package in connection with the insured disputes. If the conflict that triggered the costs already existed before the insurance contract was concluded, the insurer will not pay.

In addition, you have to wait about three months before you can claim insurance benefits. The waiting period is intended to protect the insurer against you taking out insurance only after costs and legal disputes have been announced. Only in connection with traffic accidents, your legal protection insurance is available to you without a waiting period.

Please note that there are cases in which legal protection insurances generally do not pay. These are:

What your legal protection insurance costs depends on which insurance package you choose. You can get a traffic legal protection tariff for around 70 euros per year. If you opt for a legal protection insurance that covers several areas (professional, private, traffic and criminal legal protection), the insurance will cost at least 200 euros per year. The following applies: The more legal areas the insurance covers, the more expensive it is.

If you have decided to take out legal protection insurance, it is important to compare the rates of several providers. The one tariff that suits all insured persons does not exist. When making your choice, pay attention to the rate details that are important to you personally. But don't choose the first provider that meets your rate requirements - pay attention to the following points as well:

If you decide not to take out legal protection insurance, you are not without protection in connection with many legal disputes. Although the alternatives do not offer the comprehensive protection of a legal protection insurance - they are a real relief in case of emergency:

The cost of private health insurance (PHI) depends mainly on the desired benefits and the age of the insured person when the contract is concluded. However, there are price differences between different insurance providers. We will now show you what private health insurance costs you should expect and what you should look out for in your private health insurance.

How much you have to pay for your private health insurance does not depend on your income - unlike in the case of statutory health insurance. Rather, the insurer determines your private health insurance premium primarily based on the following points:

This means that although you cannot influence your age and state of health at the time of signing the contract, you still have a say in determining your PKV costs. After all, the range of benefits included in your private health insurance - unlike in statutory health insurance - is not prescribed by law.

You decide for yourself which benefits you would like to receive from your private health insurance. The more comprehensive your chosen tariff, the higher your private health insurance costs and the lower the cost risk in the event of illness.

The cost of private health insurance varies from person to person. The following will give you an idea of how the insurer calculates the premium based on individual factors:

As part of the health check, you must provide information about allergies, lifestyle habits, previous illnesses and other health problems. The questions help the insurer to estimate your expected actual health costs

Although it is not possible to say in general how much insured persons pay for their private health insurance, a rough guideline can be used:

Salaried employees: For a high-performance PKV tariff, a 35-year-old employee pays about 500 to 700 euros. However, the employer pays half of the costs of private health and long-term care insurance. Note, however, that he only has to make a monthly contribution of a maximum of 403.99 euros.

Self-employed: Self-employed persons must finance their PKV contribution completely out of their own pocket. They have to expect (at an entry age of 35) costs of 460 to 640 euros per month.

Both groups can claim their own contribution paid as a tax deduction.

What you have to pay for your private health insurance depends, among other things, on whether you are employed, self-employed or a civil servant. For different occupational groups, different regulations apply around the PKV, which can affect the costs of private health insurance for you:

This means: If your private health insurance costs 500 euros per month, your employer will pay a subsidy of 250 euros per month.

In younger years, private health insurance is often cheaper for high earners than statutory health insurance. However, you shouldn't just spend the contributions you save. There is a simple reason for this: the premium costs for your private health insurance increase over the years. If you have a lower income in retirement, you must be able to continue to finance your private health insurance costs.

However, your private health insurer also helps you to finance your premium costs in old age: It sets aside a portion of the premiums you pay as so-called age reserves. The money saved is later used to cushion and moderate premium increases.

For you, this means that if you enter private health insurance at a young age, you have plenty of time to build up age reserves. The younger you are when you take out the contract, the greater the premium relief in old age.

If you can no longer afford the costs of your private health insurance, you have the option of reducing them. On the one hand, you have the option of changing your private health insurance tariff and opting for a similar, but cheaper tariff from your provider.

If the costs of the PKV cannot be reduced by a tariff change, a change into the legal health insurance or (if you do not fulfill the conditions for the change) into the basis or standard tariff can be a way out. The basic tariff can only be a way out if you receive unemployment benefit I.

Whether in private or professional everyday life - even minor carelessness and oversights can have serious consequences. If you forget to turn off your stove or cross a street in your mind and overlook a cyclist, serious damage can occur. You have to pay for these. In such cases, your liability insurance relieves you of the burden of existentially threatening claims for damages and bears the costs of third-party liability claims. Find out now what other benefits your liability insurance provides, for which areas you can take out insurance and when it is mandatory.

Liability insurance is damage insurance for which an individual insurance contract is concluded between the policyholder and an insurance provider.

The purpose of liability insurance is to defend against unjustified claims for damages by third parties against the insured or to assume justified claims for damages against the insured.

Your liability insurance compensates for damage you cause to third parties. It protects you financially against claims for damages from other people or companies and pays for them if they are justified. In principle, liability insurance covers the following types of damage:

Note, however, that there is no liability insurance that will financially compensate all types of damages you cause to third parties. Rather, there are different types of liability insurance for specific areas of life and different purposes. The insurances only pay if a damage occurs in connection with the agreed insurance purpose.

Many different types of damage can occur at work as well as in everyday life. Accordingly, there are different types of liability insurance that cover different types of damage. What all insurances have in common is that they only pay for damages that you unintentionally cause to others within their area of responsibility.

Overall, the different types of liability insurance can be divided according to their area of responsibility. On the other hand, a distinction can be made between voluntary liability insurance and compulsory liability insurance:

Liability insurance for risks in the private sphere

Compulsory liability insurance

These insurances must be taken out by everyone who exercises a corresponding profession or drives a motor vehicle

When you take out a liability insurance policy, your insurance contract specifies in which cases insurance coverage is available and for which types of damage the insurance will pay. Depending on the type of liability insurance, the insured types of damage can be quite different.

However, what all liability insurance policies have in common is that they do not cover damage that is

Most liability insurance policies are taken out voluntarily to protect you against certain financial risks. Mandatory liability insurance is only required in a few areas of life that are classified by law as particularly risky.

But remember: If you cause damage to another person, you are liable for the financial consequences with all your assets. Private liability insurance in particular, which covers all damage caused in private everyday life, is therefore important for everyone. The insurance protection gives you security and can save you from financial ruin under certain circumstances. The same applies to special pet owner liability insurance if you have a dog. After all, even the most agreeable four-legged companion can cause great damage if it injures a third party while playing or breaks loose in traffic.

If you run a business or are self-employed or freelance, a business or professional liability insurance makes sense for you. Like all other liability insurance policies, you take out this insurance in your own interest. However, liability insurance also serves a social purpose and guarantees appropriate compensation to people and companies who are harmed through no fault of their own. It does not matter whether you yourself are solvent or not.

You usually take out liability insurance for one or more years. However, the Insurance Contract Act (VVG) limits the minimum contract term to a maximum of three years. After the minimum contract period, the contract is automatically renewed. However, you can cancel it with a notice period of usually three months before the expiration date.

If there is an increase in premiums, you have an extraordinary right of termination. In this case, the notice period is one month from receipt of the premium increase.

Regardless of the contractually agreed minimum term, the insurance contract can be terminated by either party after a settled or rejected claim. The notice period is then - depending on the agreement - usually four weeks.

Are you currently undergoing treatment at the dentist? Once the dentist has issued the findings, you can (almost) no longer take out a dental plan. Supplementary dental insurance for ongoing or advised treatments is your only option. In this article, we'll show you the options with immediate coverage. Most of these plans are tailored to a very specific situation, e.g. for dentures. A professional consultation is recommended. Feel free to contact us, we will help you find the right tariff.

In Germany, normal supplementary dental insurance is only available to members of a statutory health insurance scheme. Those who have private health insurance cannot take out additional cover. The benefits for dental prosthesis and treatment are already included in the private health insurance.

Immediate protection applies to these treatments: Dental prosthesis

When does UKV make sense?: 1 to 3 missing teeth, treatment not yet started

Scope of benefits UKV High-quality dentures, e.g. implants

UKV DentalPRIVAT Premium - 25,92 Euro/month

UKV DentalPRIVAT Optimal - 13,75 Euro / month

Immediate coverage applies to these treatments: Dentures, dental treatment, fillings

When does the Bayersiche make sense? Treatment advised or already started, costs greater than 800 euros

Scope of benefits Bayerische ZahnSofort: 1,500 euros for advised / ongoing treatment spread over two years

The BavarianZAHN Smart + ZAHN Immediately - 44,90 Euro/month

The Bavarian ZAHN Prestige + ZAHN Immediately - 71,10 Euro/month

Immediate coverage applies to these treatments: Dentures

When does ERGO make sense? Dental prosthesis measure recommended or already started, fixed cost allowance GKV greater than 813.60 euros.

Scope of benefits ERGO ZEZ: Doubling of the fixed allowance of the GKV for dental prosthesis

ERGO ZEZ - 33,90 Euro/month

Immediate cover applies to these treatments: Orthodontics for children

When does ERGO make sense: orthodontic treatment for child advised or already started

Scope of benefits ERGO KFO Immediately: 50-75% for orthodontic treatment, 100% for prophylaxis, dentures and dental treatment

ERGO Orthodontics Immediate KFO

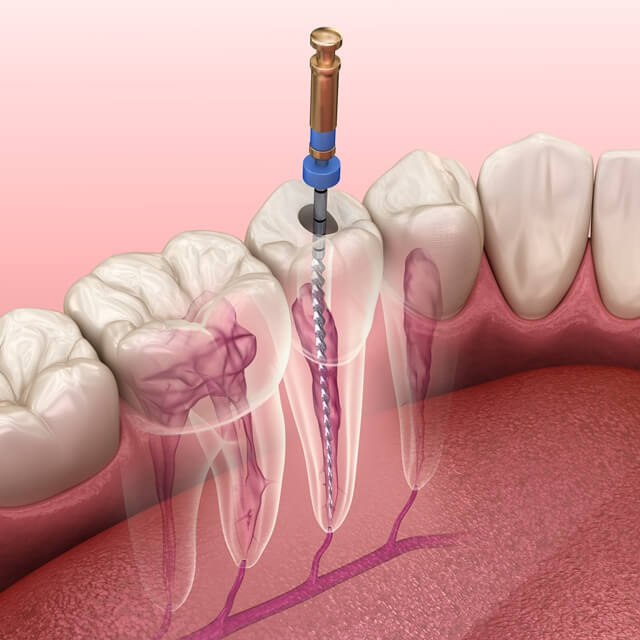

Many people first think about supplementary dental insurance when they go to the dentist for their first major dental treatment. The additional private medical measures for the treatment of a tooth gap with an implant are not covered by the statutory health insurance. The co-payment for a treatment quickly reaches 2,000 to 3,000 euros. For a root canal treatment, the co-payment is somewhat more favorable in the range of 200 to 1,000 euros.

Once the dentist makes a diagnosis, most 'normal' dental plans fall away as an option. At least if you want benefits for this dental procedure or root canal treatment. Only a few companies offer insurance coverage with cost absorption for this special case. ERGO with the tariff Zahn-Ersatz-Sofort, UKV / BBKK with the three tariffs ZahnPremium, ZahnOptimal and ZahnKompakt as well as Bayerische with the additional module "ZAHN Sofort" are your current options.

Due to the special situation, these dental insurances are not favorable for current and advised treatment. However, in many cases the tariffs are reasonable and worth their price. Each of the tariffs has its own peculiarities and is suitable for certain situations. Important for the selection of the appropriate dental insurance are:

Our tip: Call us: 0800 5565194 - We will advise you individually and without obligation about your options for advised and ongoing treatments.

1. advised treatment:

If your dentist or orthodontist has identified a specific need for treatment during a check-up and discussed this with you, this is already considered to be advised dental treatment. It is irrelevant whether or not a treatment and cost plan has already been drawn up for this specific treatment.

What is decisive is the patient file at the dentist's office. From this, the recommended treatment can also be derived later for the insurance company. Treatment is recommended if, for example:

Important: When taking out dental insurance, usually only those measures that have been diagnosed and discussed within the last two years are relevant. Before answering the health questions of a supplemental dental plan, speak with your dentist and review what is noted in the patient's record.

2. Ongoing treatment:

Once you have had your first treatment appointment with your dentist or orthodontist for a specific treatment and cost plan, the treatment is considered ongoing. Up to this point, it is advised. For the conclusion of a dental supplementary insurance, the beginning of the treatment is a decisive moment. The choice of tariffs is reduced again.

As a dental supplementary insurance for an ongoing treatment (if you want to include this measure in the insurance coverage) only the tariffs Zahn-Ersatz-Sofort of ERGO and all tariffs of the Bayerische Zahnzusatzversicherung with the additional module ZAHN Sofort remain. In this module, you will receive cost coverage of up to 1,500 euros for any type of treatment.

3. intended treatment:

Even if you have not yet seen a dentist, certain dental prosthesis measures or dental treatment may be planned or intended. This is the case if it is obvious to you that you will need or want to visit the dentist in the near future due to a measure. For example, this applies if

Our tip: Before taking out dental insurance, contact us on 0800 5565194. We will explain all the tariff details to you in detail and help you fill in the health questions.

Until 10/2021, there was no supplementary dental insurance for ongoing / advised measures for every situation. The insurance companies selected here again after the kind of the dental treatment and/or measure with the dentist. Only treatment related to dentures, i.e. bridges, implants, crowns and prostheses, could be insured. With the introduction of the Bayerische ZAHN Sofort tariff module, other measures such as root canal treatments and fillings can also be insured retrospectively.

Supplementary dental insurance can be taken out retrospectively for:

The following cannot be insured:

What you should avoid at all costs is taking out supplementary dental insurance and concealing ongoing or advised treatment when making an application. You are obliged to provide truthful information when you apply for dental insurance.

The verification of your information will take place no later than the first major dental bill. The insurance company will then ask to see the dentist's patient file. There, it is easy to see whether treatment was already advised or ongoing at the time the insurance was initiated. In other words, whether there were any findings. In the worst case, you will be threatened with cancellation by the insurance company. You will not receive any benefits and your premiums paid up to that point will be lost. These consequences can occur in the event of a breach of obligation:

It is important to choose the right tariff for an existing or contemplated dental treatment. Due to the media awareness through TV commercials, we often receive inquiries about the ERGO ZEZ tariff. But is this tariff always the best choice? Certainly not. On the contrary: this supplementary dental insurance only makes sense for a very special situation. You have just received a treatment and cost plan for dentures from your dentist and the fixed allowance of the GKV exceeds 814 euros.

If the GKV only subsidizes 300 euros for the dental prosthesis or if it is a filling, root canal treatment or an orthodontic measure, this tariff is the wrong choice. Even in the case of a fixed allowance above 814 euros, ERGO is not necessarily the most sensible choice. Under certain circumstances, the tariffs of UKV or SDK may be more suitable for you, as the reimbursement may be higher. Therefore, before taking out supplementary dental insurance for current or recommended treatments, we always recommend a professional consultation. This is the only way to ensure that you will receive what you expect from the insurance. Feel free to call us, we will help you with your decision.

Supplementary dental insurance without health questions means that the previously described case of a breach of the duty of disclosure cannot occur. There is no health check when you apply and you are guaranteed to be accepted by the insurance company - regardless of your current dental health. You can take out this supplementary dental insurance at a later date, even if you are currently undergoing a procedure at the dentist.

However, these plans generally exclude coverage for advised or ongoing treatment. Missing teeth cannot be covered. The insurance cover only includes future diagnoses.

Our tip: Dental insurance without health questions is an excellent alternative if your ongoing / advised treatment is no longer insurable or the price-performance ratio does not justify taking out the somewhat more expensive tariffs.

In the table you will find our recommendation when which supplementary dental insurance fits best.

| Type of treatment | Our recommendation | |

| Advised denture | expensive/expensive | tariff with benefit for dental prosthesis measures: UKV dental insurance BBKK dental insurance ERGO ZEZ dental prosthesis immediately Bavarian dental insurance |

| cheap/short | Dental insurance without health questions: Nürnberger Dental Insurance Deutsche Familienversicherung Dental Insurance Münchener Verein Premium uniVersa dent|Private R+V dental insurance ERGO dental insurance (advised treatments are excluded - coverage for future risks) | |

| Ongoing dental prosthesis | expensive/expensive | tariff with benefit for dental prosthesis measures: ERGO ZEZ Dental Immediate Bavarian dental insurance |

| cheap/short | dental insurance without health questions: Nürnberger Zahnversicherung Deutsche Familienversicherung dental insurance Münchener Verein Premium uniVersa dent|Private R+V dental insurance ERGO dental insurance (advised treatments are excluded - coverage for future risks) | |

| Advised or ongoing treatments (e.g. root canal treatment) | expensive/expensive | tariff with benefits for dental treatment: Bavarian dental insurance |

| cheap/short | Dental insurance without health questions: Nürnberger Zahnversicherung Deutsche Familienversicherung dental insurance Münchener Verein Premium uniVersa dent|Private R+V dental insurance ERGO dental insurance (advised treatments are excluded - coverage for future risks) |

If you have been advised to have dentures or dental treatment, or are already undergoing ongoing dental procedures, your options are very limited. Dental insurance with immediate coverage for these diagnoses is the only way to get coverage. Whether the insurance is worthwhile depends on the individual diagnosis and the existing treatment and cost plan.

We recommend that you consult an expert who will explain the advantages and disadvantages of this special insurance solution in detail. Give us a call. Our consultation is free of charge and without obligation.

First things first: for almost all dental complaints, there are treatment options that are paid for in full or in part by the statutory health insurance.

We will show you which health insurance benefits you are entitled to at the dentist and which costs are covered by law. Basically, treatment is carried out according to medical necessity, but also from an economic point of view.

The best and most modern treatment methods are usually also expensive options. There is not always room for them in the benefits catalog of the statutory health insurance. If you have a private health insurance, it depends on your contract what is covered.

With private supplementary dental insurance, you can close the gap in the benefits provided by statutory health insurance and reduce your own contribution to the dentist to as little as 0 euros. The selection of the right tariff is crucial.

Important to know: According to the Social Security Code, your dentist must offer a health insurance benefit if he or she is licensed to do so. This is because people with statutory health insurance have a right to such treatment and it may not be refused. It doesn't matter whether it's a simple filling or a complicated root canal treatment - your dentist is obliged to inform you of the statutory health insurance benefits and treat you accordingly.

In addition, the dentist may then offer additional private medical services and bill you according to the private fee schedule for dentists. These additional services may be of the same or different nature.

Similar additional service: The treatment method corresponds to the standard treatment, but an additional service is added: for example, a tooth-colored veneer is added to the crown in the posterior region.

Different type of additional service: The treatment differs from the standard treatment, e.g. a gap between the teeth is treated with an implant instead of a bridge.

The dentist is also obligated to inform and advise you about all essential circumstances of the diagnosis or therapy. This includes, for example, the type and scope of a necessary measure and the associated risks of dental treatment.

You will find explicit regulations on this in §630 of the German Civil Code (BGB). The information also includes advice on the financial aspects of the treatment, i.e. also on the possible co-payment, e.g. for high-quality dentures.

Statutorily insured persons are entitled to a fixed allowance from the public health insurance fund for dental prostheses. The decisive factor is not the type of denture actually selected, but the dentist's findings in the treatment and cost plan. Depending on the findings, there is a medically necessary and financially economical standard provision. Since 01.10.2020, the health insurance company will pay 60 to 75 percent of this standard treatment in the form of a fixed allowance.

It does not matter whether you opt for this care option or want a higher-quality treatment by the dentist. The health insurance company always pays only the fixed allowance for dental prostheses. Anything above this standard treatment is billed privately and is your own contribution.

The standard treatment for dentures is usually a metal bridge in which the neighboring teeth are ground down. Many patients therefore opt for higher-quality treatment in the form of implantology. The treatment is gentler and does not damage neighboring teeth. However, the cost of dental implants is also many times higher than standard treatment.

Example: Cost coverage of the statutory health insurance for dental prosthesis.

Findings: Tooth gap in the posterior region (not visible).

| Treatment | Costs covered by health insurance | payment |

| Bridge without veneer (standard treatment) Costs e.g. 660 Euro | 60 percent 396 Euro | 40 percent 264 Euro |

| Ceramic implant Costs e.g. 3,000 Euro | fixed allowance for standard treatment 396 Euro | 80-90 percent 2.670 Euro |

The health insurance company pays up to 100 percent of the dentist's bill for fillings. It depends on whether you opt for the standard treatment or want a higher-quality filling in the color of your teeth. The health insurance covers amalgam fillings for posterior teeth and plastic fillings for anterior teeth.

If you decide to have a tooth-colored filling in the posterior region as well, this is a similar higher-quality restoration: The health insurance fund will cover the cost of the amalgam filling. The difference of 40 to 100 euros to the more expensive option is your own contribution.

Another form of private medical care is a so-called inlay, which is specially developed as a filling in the laboratory. It is made of gold or ceramic. The health insurance does not cover any additional costs for inlays; you receive the normal allowance for the filling. The co-payment for an inlay is between 300 and 600 euros. Our current recommendations for dental tariffs cover up to 90 percent of these treatment costs.

The health insurance company will pay up to 100 percent of the dentist's bill for an apicoectomy or root canal treatment. The decisive factor is whether the tooth is classified as worthy of preservation or not - because only then is it a health insurance benefit.

If the tooth is not classified as worthy of preservation, the treatments are 100 percent private benefits. In the case of private supplementary insurance, it is important that this covers the costs of root canal treatment even without SHI advance payment.

As with fillings and dentures, there are also different methods of root canal treatment. The health insurance company pays for the standard treatment, but the additional costs for a gentler or more modern method must be borne by the patient.

The most important preventive measure is the check-up at the dentist. This examination is covered by the health insurance once every six months. The dentist detects diseases at an early stage and can take measures in time. In addition, you increase your fixed cost allowance for dental prostheses through consistent preventive care and keeping a bonus booklet.

The health insurance also covers the costs of tartar removal once a year. Since 2004, periodontal screening has also been included in the benefits provided by the health insurance fund.

Professional dental cleaning (PZR), on the other hand, is not covered by the SHI benefits catalog and must be paid out of pocket. Dentists recommend that PZR be performed at least 1-2 times a year. A good supplementary dental insurance will cover the costs completely. There are also tariffs that cover up to 300 euros per year for bleaching.

In 2002, the so-called orthodontic indication groups - KIG for short - were introduced. Here, the malocclusion of the teeth is divided into degrees of severity. Levels KIG 3 to KIG 5 refer to "considerable impairment" in biting, chewing, speaking or breathing. In these levels, the costs of orthodontic treatment are covered by the statutory health insurance. However, 20 percent of the treatment must initially be paid by you as your own contribution. After successful treatment, this will be reimbursed.

The statutory health insurance does not pay for additional private medical services such as internal braces, colorless arches or other modern and aesthetic treatment options. Likewise, there is no cost coverage for braces of the health insurance in the KIG levels 1 and 2. For adults from the age of 18, there are only in a few exceptional cases benefits of the GKV.

It is therefore particularly advisable to have supplementary dental insurance for children, which covers the costs of additional lines and also pays for medically necessary measures in the event of a classification in KIG 1 and 2.

In principle, the statutory health insurance allows for a solid dental care. In many forms of therapy of the standard care, the health insurance benefits up to 100 percent, in dental prostheses about half. However, the keyword is standard care, i.e. medically necessary, simple and economical care.

If you want more and want to have access to modern, aesthetic treatment methods, you should think about private supplementary dental insurance in good time. Especially in the case of expensive dental prosthesis measures, e.g. with implants, the personal contribution can be significantly reduced in this way. We can help you find the best supplementary dental insurance for your individual needs.

The task of a healthcare system to maintain the health of a population is not a simple matter. For this purpose, the German health care system consists of several institutions, groups, organizations, professionals. In the following, you will learn which elements make it up and how the health care system in Germany works. In particular, we show which forms of health insurance are available to you.

What is the idea behind the healthcare system in Germany? This question is answered by the following four basic principles that define and organize the German health care system and how it works.

Broadly speaking, the German healthcare system can be described as being divided into three levels:

In Germany, health insurance is compulsory for all citizens. However, individuals are free to choose which health insurance company they would like to be insured with. There are currently almost 150 health insurance companies in Germany, between which you can choose. This number includes both statutory health insurance companies and providers of private health insurance.

Most important in this respect is the difference between statutory health insurance and private health insurance. Just under ninety percent of the German health insurance population, a little over 70 million people, are insured through a statutory health insurance fund.

For expats, the most popular choice is TK (techniker) health insurance. The rest of the population has private health insurance. Here are different options for expats, depending on their wishes and budget. How the German health insurance system works, is explained below.

Statutory health insurance is the main form of health insurance in Germany. Their task is to financially secure the health of the insured. This is done by providing financial support in the event of an insured event. If you need medical treatment, your health insurance will cover the costs incurred.

The amount and the frequency of the cost coverage as well as the scope of services of the insurance are regulated by law: All persons with statutory health insurance are basically entitled to the same benefits in accordance with the German Social Code (SGB V).

Statutory health insurance funds are financed according to the solidarity principle. This means that the insured themselves pay regular insurance contributions and in return receive the insurance benefit when they need it. The health insurance contribution depends on the individual gross income and amounts to 14.6 percent of the same.

The contribution rate includes daily sickness benefits. If you choose to insure yourself without daily sickness benefits, the health insurance contribution is calculated on 14 percent of your gross income. In addition, an individual contribution rate is added. For salaried employees, the employer usually pays half of the health insurance contributions.

According to the Social Security Code, the statutory health insurance funds must provide a fixed scope of benefits. Examples are:

However, the services provided must not exceed the limits of medical necessity and economic efficiency.

In addition to the mandatory benefits, statutory health insurers also offer supplementary benefits. Any extension of the scope of benefits provided by a statutory health insurance fund must in any case be approved by the competent supervisory authority. Examples of additional benefits are:

The costs of a statutory health insurance are fixed by law. The contribution rate in 2023 is 14.6 percent of income. However, statutory health insurance companies set additional contributions, which increase the total costs for the insured. The total cost of membership in a statutory health insurance fund is between 14.95 and 17.1 percent of your gross income.

However, if your income as an employee exceeds 66,600 euros per year (2023), you are above the compulsory insurance limit and are therefore exempt from insurance. In this case, you can decide for yourself whether you want to remain voluntarily with your statutory health insurance or switch to a private health insurance.

If you are self-employed or if your annual gross income as an employee exceeds 66,600€, you can choose between statutory and private health insurance. As far as compulsory insurance is concerned, statutory and private health insurance are equal. That is, in both cases your insurance obligation is fulfilled.

Are you thinking about taking out private health insurance? Then there are some differences to statutory health insurance that you should consider. These are basically related to the fact that private health insurances are privately managed and not organized under public law. This has some consequences.

You contractually agree the scope of benefits with the insurer. The so-called equivalence principle applies, i.e. the principle of equivalence of benefits and services. In this way, you can choose the benefits you want and determine the amount of the insurance premiums in proportion to them.

The same applies to the insurance of family members. There is no contribution-free co-insurance of family members such as children and spouses with private health insurance.

Finally, you must also note that the billing between the health care facility or doctor and you does not take place via the health insurance company: The private insurance company will reimburse you for the costs incurred only after the fact. In most cases, there is an exception for standard inpatient services: These are often settled directly with the insurer and you then receive a statement of benefits from your insurer.

Private health insurance is not an option for everyone. This is because you are only allowed to take out private health insurance if you belong to certain groups of people regulated by law. These are:

If you have the option of taking out private health insurance, you benefit from a broader scope of services than with a statutory health insurance plan. It is important to know that the booked benefits are agreed with the insurer. This means that you can adjust them to your individual needs.

The range of benefits varies, of course, depending on the insurer. In principle, however, you can expect the following additional benefits:

If your gross income exceeds 66,600 euros (as of 2023), your insurance obligation ceases at the end of the calendar year. This means that you can either remain voluntarily registered with the GKV or switch to a private health insurance. If your gross income is above the insurance limit, you will then be declared exempt from insurance after one year. If this declaration is made, you then have three months to decide to switch to private health insurance.

The return from a private health insurance to the GKV is only possible in certain cases. Basically, it applies that due to your life circumstances an insurance obligation arises again - for example, by the fact that you earn your living as an employee and your gross income remains below the insurance obligation, or because of unemployment. After the age of 55, however, this becomes very difficult.

Private insurers offer you supplementary health insurance in addition to the basic tariff. The purpose of these special tariffs is to supplement and complete your insurance coverage. They are compatible with both statutory and private health insurance. The purpose is to insure you for special cases, which can be adapted to your individual needs. This is especially useful if you are a member of a statutory health insurance. This way you get a more comprehensive insurance coverage.

If you are insured with a private health insurance company, it might also be worthwhile to take out special supplementary insurance policies if they are important to you. However, some insurers do not allow this and in any case it must be about supplementary and not substitute services. You must also make sure that the supplementary health tariffs do not result in overinsurance: That is, you pay twice, although the insurance case is covered by your PKV ready. In this respect, an insurance broker can help you to arrange your health insurance sensibly.

Classic examples of supplementary health insurance are:

Germany's health care system is structured in such a way that it benefits both from a principle of solidarity due to the way it is financed and from the economic efficiency of the services provided - because the health insurance system helps to determine the health care system.

Various players come together in the health care system: Hospitals, central and regional institutions, associations of patients, doctors, health professionals, and pharmacies. The function of all this cooperation is to protect the health of the population nationwide.

It is important to know that in Germany there is compulsory insurance as far as health is concerned. This means that all citizens must have health insurance. This is done either through the statutory health insurance funds or through private health insurance. While the scope of benefits offered by a statutory health insurance company is fixed by law, the private offer varies depending on the insurer.

Beyond the statutory health insurance and private health insurance, you can take out additional health insurance to round out your statutory or private insurance coverage as desired. Supplementary health insurance policies cover specific insurance cases, such as benefits from alternative practitioners or inpatient accommodation and private doctors.

A dental treatment abroad is becoming increasingly popular. This is because statutory health insurers only cover a fraction of the costs for many treatments. For members of the public health insurance system, this can mean a high personal contribution, especially for expensive dentures. For this reason, more and more patients are seeking dentists abroad. But where is it worthwhile to seek dental treatment at all, and does the health insurance company also contribute to the costs abroad?

Especially in Eastern European countries such as Poland, Hungary and the Czech Republic, but also in Turkey, dental treatment abroad can be worthwhile. This is because wages are generally lower in these countries, which reduces the fee costs. In addition, laboratory and material costs are also lower, which can lead to savings of several thousand euros.

However, there are costs associated with dental treatment abroad that are not incurred by a local dentist. These include expenses for travel, accommodation and meals. And depending on the procedure, patients may have to stay abroad for several days to attend not only for the treatment itself, but also for pre- and post-treatment care. This can significantly increase the overall costs.

In addition, depending on the measure, several appointments may be necessary, with weeks or months between them. For example, in the case of an implant. This is because it must first heal for three to six months before the final denture can be fitted. As a result, a second visit may be necessary. Some dental practices offer a so-called all-round package.

This includes other services in addition to the dental procedures. For example, accommodation and transport to and from the practice. However, in any case, it should be noted that the costs must always be paid immediately. Often even in cash. This is because not all foreign dental practices offer payment by instalments or financing.

Dental clinic in Hungary with certification

| Denture (implants with bone augmentation) | 5,450 Euro |

| Travel costs | 250 Euro |

| 10 nights in a simple hotel with private bathroom | 870 Euro |

| Total costs | 6,570 Euro |

For comparison: In Germany, a single implant including bone augmentation costs between 1,300 and 4,000 euros. Plus about 750 euros for the ceramic crown that is placed on top. For a full denture, you need a minimum of two implants and crowns. In Hungary, a single implant costs between 550 and 900 Euros.

| Dentures (ceramic bridges on implants) | 6,400 Euro |

| Travel costs | 250 Euro |

| 7 nights in a simple hotel with private bathroom | 870 Euro |

| Total costs | 7,520 Euro |

For comparison: For the same treatment in Germany, the patient pays from 10,000 euros depending on the fee, material and laboratory costs.

In addition to the total costs, there are expenses for meals and public transportation.

Many doctors present their services and practices on the Internet. More important than pictures, however, are the qualifications of the doctor. An existing certification such as an ISO mark can be an aid to assessment. This indicates that the practice is regularly inspected. The same applies to materials.

The consumer advice center advises looking for a suitable dentist abroad through one's own health insurance company. Many health insurance companies have contracts with dentists who must meet certain standards.

The statutory / public health insurance as well as private health insurance contributes to the costs of dental treatment abroad within the EU. The amount depends on the statutory standard of care or on your private health insurance contract. But in any case, you should have the treatment approved by your insurer in advance. For this purpose, the dentist prepares a treatment and cost plan, which is submitted to the health insurance company.

This not only has the advantage that patients know how much their co-payment will be before treatment begins. The dentist can also settle directly with the health insurance company. This means that patients do not have to pay in advance and only have to pay their own share to the dentist. If you have a private insurance, you settle the bill with the dentist and get a refund afterwards.

If the treatment is carried out without the approval of the health insurer, patients can still submit the invoice to their insurer. However, they must have the document translated at their own expense. But be careful: A prerequisite for the fixed permission for dentures is that the insured person has previously submitted a treatment and cost plan. And this must have been approved by the health insurer.

Dental insurance is designed to close the gap in coverage provided by statutory health insurance. Depending on the tariff, it pays the co-payment in full or on a pro rata basis. In this way, supplementary dental insurance not only protects against high costs at the dentist. It also makes beautiful teeth affordable.

Many dental insurers offer coverage not only in Germany. They also provide coverage for treatment in other European countries or worldwide. However, as with health insurance, it is advisable to discuss the planned measure with the insurer beforehand. In this way, the insured not only receive a fixed cost commitment, provided that the treatment is covered. They also know how much the company will contribute.

| Cost of dentures (ceramic bridges on implants in the posterior region) | 6,400 Euro |

| Fixed subsidy from the health insurance company | 600 Euro |

| Own contribution without dental insurance | 5,800 Euro |

| Cost sharing of supplementary dental insurance (90% for dentures) | 5,160 Euro |

| Own contribution with dental insurance | 640 Euro |

Without supplementary dental insurance, the co-payment for the dental prosthesis is 5,800 euros. Due to the good benefits of dental insurance, the co-payment is reduced to 640 euros. In addition, expenses for travel, accommodation and meals are incurred during treatment abroad. The insured persons bear these costs in full themselves.

The following insurers and tariffs offer benefits for dental treatment abroad:

| Barmenia Mehr Zahn 100 | Gothaer MediZ Duo90 | MüV ZahnGesund 85+ | |

| Denture with implants | 100% | 90% | 85-90% |

| Professional tooth cleaning | none | 100% | 85-100% |

| Dental fillings | none | 100% | 85-100% |

| Root canal treatment | none | 100% | 85-100% |

| Premium at age 35 | 22.50 Euro | 25.90 Euro | 17.90 Euro |

Good supplementary dental insurance not only provides coverage in Germany. They also provide coverage for dental procedures abroad. But regardless of this, it is always worthwhile to take out insurance to reduce the amount you have to pay at the dentist. Both in Germany and abroad.

Gothaer, Münchener Verein and Barmenia offer tariffs with good benefits for dentures in Germany and abroad. Nevertheless, it is important to tailor the tariff to your individual needs. Our experts will help you find the right tariff for your needs.

Benefit from our many years of experience. Please don't hesitate to schedule an appointment with us.